Selecting a talented Customhouse broker can be the key in helping a company advance its import operation. Companies most often have two options when importing products. First, hire a Customhouse Broker (indirect channel). Or, second, import directly from the supplier or producer of the product (direct channel). For most companies, especially small ones option number one is the most preferred.

In an era where we have numerous suppliers and producers for a single product, the service offered by World Nations USA Incorporated becomes invaluable. Our company will not only provide your company with access to valuable information, but we will also help your company in bringing your product into the U S Market, as well as arrange transportation and insurance, logistics support and help to handle the return of damaged and rejected goods, when a shipment reaches the United States.

The importer of record (i.e., the owner, purchaser, or licensed customs broker designated by the owner, purchaser, or consignee) will file entry documents for the goods with the port director at the goods' port of entry. Imported goods are not legally entered until after the shipment has arrived within the port of entry, delivery of the merchandise has been authorized by CBP, and estimated duties have been paid. It is the importer of record's responsibility to arrange for examination and release of the goods.

Assuming that you have identified a supplier that will supply your company with a quality product at the right price, the next step is to identify a customs house broker the one who will be responsible to help your company clear customs.

To facilitate and reduce customs clearance time from days to hours,

World Nations uses

ACE and Automated Systems

The Automated Commercial Environment (ACE) is the system through which the trade community reports imports and exports and the government determines admissibility.

Declaration of information on imported or exported goods, prepared by a customs broker on a prescribed form called entry Form or duty entry Form, and submitted to the customs. It states the customs classification number, country of origin, description, quantity, and CIF value of the goods, and the estimated amount of duty to be paid.

If upon examination by a customs officer the entry is verified as a correct or 'perfect entry,' the goods in question are released (on payment of duty and other charges, if any) to the importer, or are allowed to be exported. Main types of entry are:

(1) Consumption entry: for goods to be offered for sale (consumption) in the United States

(2) Formal entry: that is required to be covered by an entry bond because its aggregate

value exceeds a certain amount.

(3) Informal entry: that is not required to be covered under an entry bond because its

value is less than a certain amount

(4) In-transit entry: for the movement of goods from the port of unloading to the port of

destination under a Customs bond.

(5) Mail entry: for goods entering through post office or courier service and below a

certain value.

(6) Personal baggage entry: for goods brought imported as personal baggage.

(7) Transportation and exportation entry: for goods passing through a country en-route to

another country.

(8) Warehouse entry: for the goods stored in a bonded warehouse.

United States Customs and Border Protection (CBP) has announced a new rule, known as the Importer Security Filing (ISF) or more commonly called 10+2; which requires containerized cargo information, for security purposes, to be transmitted to the agency at least 24 hours (19 CFR section 149.2(b) before goods are loaded onto an ocean vessel headed to the U.S. (i.e. mother vessel, not feeder vessel) for shipment into the U.S. 10+2 is pursuant to section 203 of the SAFE Port Act, and requires importers to provide 10 data elements to CBP, as well as 2 more data documents (Container Status Messages and the vessel's Stow Plan)from the carrier.

The new rule, published on November 26, 2008, went into effect on January 26, 2009. CBP is taking a phased-in approach in terms of implementation and enforcement. During the first 12 months, importers will be warned of infractions instead of being fined, with the hope that the importers will establish a filing system. All ISF filings are required to be submitted electronically via the Automated Broker Interface (ABI) or the Automated Manifest System (AMS).

For shipments on the water on or after June 30, 2016, CBP had ended the phased-in approach and ISF compliance is in full effect.

If compliance is not met, liquidated damages penalties up to $5,000 may be issued by the local port for each violation.

The ISF needs to be submitted at the lowest bill of lading level (i.e., house bill or regular bill) that is transmitted into the Automated Manifest System (AMS). The bill of lading number is the only common “link” between the ISF and the customs manifest data.

Will I get a confirmation that my ISF is filed?

Yes, after your ISF is filed with US Customs. You will receive a email confirmation with the ISF transaction number and the ISF filing record copy.

If your shipment has already sailed before you have filed your ISF. You must file as soon as possible as US Customs still requires this information to see what goods are being imported into the U.S. If your ISF Filing is late, the sooner you file, the chances of penalty by CBP will be minimized.

Late ISF Filings may be subject to $5,000 penalty for each violation, and not to exceed $10,000 in aggregate if multiple offenses are committed such as late and erroneous filings.

After your ISF is filed, customs clearance services are available to coordinate releases with US Custom, Freight agent and Warehouse.

Elements of a ISF 10+2 Filing

If you are wondering what is exactly contained in the ISF Filing, there are 10 main elements in which the Importer is responsible for, and the other 2 elements are submitted by your shipping carrier. The Importer only needs to worry about their own 10 elements and the AMS Bill of Lading numbers which ties your shipment in with customs.

- Seller – Name and address of the Seller, who has sold the goods to the Buyer. The seller would be the overseas entity who have sold the goods. Sometimes this could be the same as the manufacturer of the goods.

- Buyer – Name and address of the Buyer who has paid the Seller. The Buyer is the entity who have made financial payment of the goods to the Seller. This may be the same party as the Importer of Record.

- Importer of Record – The IRS number, EIN, Social Security number, or Customs assigned of the Importer of Record. This entity liable for payment of all duties and responsible for meeting all statutory and regulatory requirements incurred as a result of importation.

- Consignee number – The IRS number, EIN, Social Security number, or Customs assigned imported number of the individual or firm in the U.S. on whose account the merchandise is shipped.

- Manufacturer – Name and address of the entity that last manufacturers, assembles, produces the good, or grows the commodity.

- Ship to party – Name and address of where the goods will go to physically after the release from Customs.

- Country of Origin – Country of manufacture, production, or growth of the article, based upon the import laws, rules and regulations of the U.S. This is the same information declared on the Customs entry.

- Harmonized Tariff Schedule number – The HTS Tariff Number under which the article is classified in the HTSUS. The HTS Code identifies all imported goods which also determines the import duty rate and any special requirements if applicable.

- Container stuffing location – Name and address(es) of the physical location(s) where the goods were stuffed into the container.

- Consolidator – Name and address of the party who stuffed the container or arranged for stuffing of the container

Master/ and or House AMS Bill of Lading Numbers: The Bill of Lading numbers when considered should be the 11th element to the ISF10+2 Filing. These Bill of Lading Numbers let CBP know which shipment your 10 data elements belong to.

The other 2 elements are provided to CBP by the carrier or steamship line:

-

Vessel stow plan

-

Container status message

Updating or Revising an ISF Filing

ISF's can be updated before the shipment arrives to the first US Port. In the world of shipping, there would be times in which your shipment would not make its journey on the original booked vessel in which the Bill of Lading Number's would change, or if there are any corrections needed on any of the 10 ISF data elements. The update can be submitted to US Customs by the party or company who has filed your ISF. Please note that if there are changes to the Arrival or Departure date in which the Bill of Lading numbers did not change. Revisions are not necessary for date changes, as the arrival and departure info is tied in with the Bill of Lading numbers which the Carrier is responsible to update with CBP.

Bond Requirements for ISF Filing

The Importer must have a bond with the ISF Filing. Either a Single ISF Bond or Continuous Bond for frequent importers is required. Bonds are non refundable financial guarantees to US Customs in the event of any claims for liquidated damages or penalties which may be applicable. Failure to post a bond with the ISF Filing will result in a rejection of the ISF Filing if bond is not secured within 12 hours after submission.

U.S. trade preference programs such as the Generalized System of Preferences (GSP) provide opportunities for many of the world’s poorest countries to use trade to grow their economies and climb out of poverty. GSP is the largest and oldest U.S. trade preference program. Established by the Trade Act of 1974, GSP promotes economic development by eliminating duties on thousands of products when imported from one of 119 designated beneficiary countries and territories. The GSP Guidebook provides basic information on the program.

GSP promotes economic growth and development in the developing world.

GSP promotes sustainable development in beneficiary countries by helping these countries to increase and diversify their trade with the United States. The GSP program provides additional benefits for products from least developed countries. The list of products eligible for duty-free treatment when imported from GSP beneficiaries can be found here.

GSP supports U.S. jobs and helps keep American companies competitive.

Moving GSP imports from the docks to U.S. consumers, farmers, and manufacturers supports tens of thousands of jobs in the United States. GSP also boosts American competitiveness by reducing costs of imported inputs used by U.S. companies to manufacture goods in the United States. GSP is especially important to U.S. small businesses, many of which rely on the programs’ duty savings to stay competitive.

GSP promotes American values.

In addition to promoting economic opportunity in developing countries, the GSP program also supports progress by beneficiary countries in affording worker rights to their people, in enforcing intellectual property rights, and in supporting the rule of law. As part of the GSP Annual Review, USTR conducts in-depth reviews of beneficiary countries’ practices in response to petitions from interested parties.

Farm Bill's First Sale Declaration Requirement

As the Trade war continues with no or little resolution in sight, tariffs put in place by both sides have raised costs for many China-based businesses.

Many of them are considering restructuring their supply chains as a result, but the deep level of supply chain integration in China, the high costs of reconfiguration, and strict rule of origin standards in the US complicate such efforts.

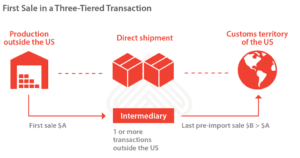

A potential way for companies to reduce their exposure to US tariffs. The secret lies in a three-decade-old customs rule in the US called the “First Sale rule”.

According to the First Sale rule, a product subject to tariffs can have its value declared based on its initial selling price rather than its final one.

Will this First Sale rule become a feasible strategy for exporters looking to reduce the impacts of tariffs?

What is the First Sale rule?

The First Sale rule applies to the Importer of Record (IOR) bringing goods into the US through a “multi-tiered” transaction model — where the product is bought and sold multiple times prior to its import into the US.

Under this rule, when declaring the customs value of the goods to pay the applicable tariff, importers can use the lower price of the goods paid in the first or earlier sale instead of the higher price paid in the last sale.

An example of First Sale into the US

for example, let’s say a Chinese manufacturer produces and sells goods at the price of US$10,000.00 to an intermediary outside the US and the intermediary in turn sells these goods to an importer in the US with a 20 percent mark-up at the price of US$12,000.00.

By leveraging the First Sale rule and using the original manufacturing price of US$10,00.00 rather than the last price of US$12,000.00 as the basis of appeasement, the importer can save US$200.00 or US$500.00 under a 10 percent or 25 percent tariff, respectively,

Maximum tariff savings

Usually, importers use the First Sale rule when there are high duty rates, high intermediary markup, or high free on board (FOB) volumes in the transaction.

Another way to save more is by restructuring the supply chain.

US Customs and Border Protection (CBP) allows certain expenditures unrelated to the production of goods (non-dutiable value) to be transferred from the manufacturer to the relevant intermediary. As a result, the first price could be cut lower without affecting the last pre-import price.

We seek to clarify the most frequently asked questions below.

What is a "series of sequential sales"? |

|

|

A series of sequential sales, common in import transactions, consists of two or more successive contracts for sales of goods. One example is where the import transaction involves a sale between the manufacturer and a foreign intermediary and another between a foreign intermediary and a U.S. buyer. |

Which is the "first or earlier" sale? |

|

|

In a series of sequential sales, as defined above, any sale occurring earlier than the last sale prior to the introduction of the merchandise into the United States would be considered a "first or earlier" sale. In the above example, the sale between the foreign intermediary and the U.S. buyer is considered the last sale prior to the introduction of the merchandise into the United States. The sale between the manufacturer and the foreign intermediary is the "first or earlier" sale. |

Should I place an "F" indicator when there is only one sale involved? |

|

|

No, when the import transaction involves only one sale the reporting requirement is inapplicable. In that instance, there is only one buyer, located in the United States, and one seller, located in another country. |

|

|

Is a sale between a manufacturer (or other foreign seller) and a non-resident importer considered a "first or earlier" sale? |

|

Where the import transaction involves a series of sales between a foreign seller and a non-resident importer and another sale between the non-resident importer and a buyer in the U.S., the sale between the foreign seller and the non-resident importer is considered the "first or earlier" sale for purposes of the reporting requirement as it is not the last sale prior to the introduction of the merchandise into the United States. The sale between the non-resident importer and the buyer in the U.S. is the last sale prior to the introduction of the merchandise into the United States. |

Why don’t more companies take advantage of the First Sale rule?

There are various reasons why more companies haven’t employed the First Sale rule, but the main reason is that businesses need to expend a considerable amount of time and resources to ensure a given transaction meets compliance and internal control requirements.

Since the information as mentioned above is often kept by different partners in the supply chain, cooperative relationships and responsibilities need to be developed between the manufacturer, the intermediary, and the importer.

Importers need to persuade other partners to disclose the “first sale” price and ensure only the right people see the sensitive documentation and data, which requires tight control over the process.

In addition, there are risks of errors and non-compliance, and failure to comply with the requirements of the First Sale rule could be construed as a lack of reasonable care and may result in a fine.

For additional information on the First Sale Declaration Requirement, please refer to Grace Period Set for Implementation of First Sale Declaration Requirement

The determining factor that is used to assess duties rate. Duty rate could be calculated on ad-valorem , or specific or compound duty. Ad-valorem is a method when a percentage of transaction value is used.

Specific duty is based on per unit or item. Compound duty is hybrid of ad-valorem and specific duty in addition to customs clearance.

World Nations USA Incorporated also provide the following services: Carrier and routing information government licensing and import quota information, warehouse and distribution services, customs bonds, insurance assistance. World Nations Incorporated can provide you with the essential by providing you with to best reliable service possible.

Founded in 1997, our mission is to provide full-service and compliance-focused customs services to importers and exporters in the U.S. Our commitment to compliance and our experience and resources set us apart from all other customs service providers. We specialize in helping small and mid-sized businesses manage their international shipments and all aspects of international trade, ensuring your goods reach their destination on time and in good condition.

Whether it's your first time importing or your company already has an established supply chain, we will provide you with the best service available and solutions that can save you valuable time and money. Businesses large and small realize the benefits of international trade, the importance of an efficient and transparent supply chain has never been greater.

World Nations USA Incorporated provides every service you will need to facilitate the movement of your products. With the cost of logistics often exceeding 25% of the total cost of international goods, we create synergy and cost savings by providing complete solutions from a single provider and can help give your company the edge you need to compete.

Send as a Message

RELIABLE AND DEPENDABLE

EXPERIENCE AND INTEGRITY

PROJECT MANAGEMENT

LOGISTIC PROVIDER